GLOBAL ECONOMICS AND POLITICS

Leo Haviland provides clients with original, provocative, cutting-edge fundamental supply/demand and technical research on major financial marketplaces and trends. He also offers independent consulting and risk management advice.

Haviland’s expertise is macro. He focuses on the intertwining of equity, debt, currency, and commodity arenas, including the political players, regulatory approaches, social factors, and rhetoric that affect them. In a changing and dynamic global economy, Haviland’s mission remains constant – to give timely, value-added marketplace insights and foresights.

Leo Haviland has three decades of experience in the Wall Street trading environment. He has worked for Goldman Sachs, Sempra Energy Trading, and other institutions. In his research and sales career in stock, interest rate, foreign exchange, and commodity battlefields, he has dealt with numerous and diverse financial institutions and individuals. Haviland is a graduate of the University of Chicago (Phi Beta Kappa) and the Cornell Law School.

Subscribe to Leo Haviland’s BLOG to receive updates and new marketplace essays.

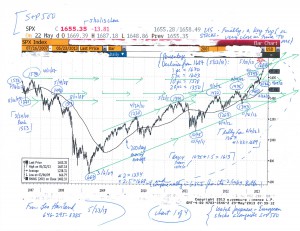

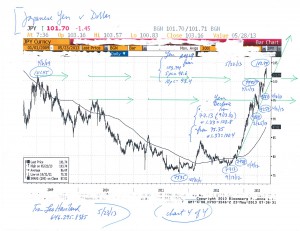

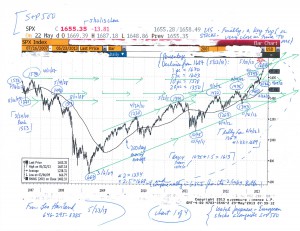

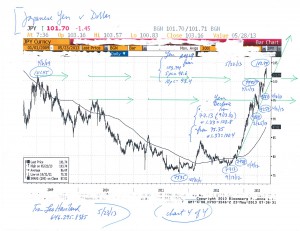

See the following four charts of US stocks (S+P 500), broad Goldman Sachs Commodity Index, Japanese stocks (Nikkei), and the Japanese Yen versus the US dollar.

The S+P 500 chart states: “US Stocks: Finally, a key top (or very close in time to one)” and gives “percentage declines from 1687 (5/22/13)”. It adds: “watch Japanese + European stocks alongside S+P 500”. Note the comments on the other charts.

Charts- S+P 500, Broad GSCI, Nikkei, Yen (5-23-13, for US Stocks- Finally, a Key Top essay)

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

US Stocks- Finally, a Key Top (Or Very Close in Time to One) (5-23-13)

Currency war fears and realities often reflect widespread economic crisis worries. From time to time during the ongoing international economic crisis that emerged in 2007, marketplace wizards and political sages have warned of currency wars. Many such observers label and bemoan currency battles as “bad”, especially if such competitive devaluations involve several key trading nations around the globe. Nevertheless, many countries view devaluation of their home currency (whether “in general”, or in a cross rate against another nation) as “good”, at least so long as such tumbles are “not excessive”. Might depreciation boost exports and thus help to generate the blessings of growth? Or, might depreciation (at least up to some point) reduce the burden of outstanding debt obligations denominated in the home currency? Thus, in some realms (or at least for powerful economic camps within such territories), depreciation (and sustained currency weakness) ironically often is akin to a military victory.

In recent months, the US dollar and Japanese Yen have fallen, the Yen especially dramatically. However, the greenback already was feeble from a longer run historical vantage point, and its erosion has been rather steady since around June 2012. In America, the Federal Reserve and many politicians clearly endorse a relatively weak dollar. Look at the Fed’s massive and sustained money printing and rock-bottom Federal Funds rate. Have American economic generals in recent months been shouting about the merit of a “strong dollar”? The recent Japanese election and political pressures has accelerated the Yen’s weakness that emerged during 2012.

A weak US dollar in recent years often has been associated with bullish moves for US equities (S+P 500). Recent Yen weakness helped to rocket Japanese equities (Nikkei 225) sharply higher from their 6/4/12 (8240) and 10/15/12 (8490) valleys. The Yen’s weakness began from a so- called very strong level, so perhaps its decline will enhance Japan’s economic growth. Will this Japanese expansion, if it occurs, do so at the expense of others? Perhaps.

For the US, the broad real trade-weighted dollar probably will challenge its July 2011 record low depth in the relatively near future. A decisive breach of that bottom would not be surprising. A challenge of the July 2011 low, and therefore a break beneath it, probably would not be bullish for the S+P 500.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Currency Wars, Dollar and Yen Slides (2-1-13)

The major bull charge by the Japanese 10 year government bond (JGB) to lower yields probably ended in late July 2012, or will do so soon. The Japanese Yen’s long run bull trend (effective exchange rate basis, Bank of England data) likewise probably ceased in midsummer 2012.

Four significant inflationary variables have or likely will entangle with the massive Japanese easing to date. First, major central banks around the world via various methods have engaged in extravagant easing. Consider the money printing (QE1, 2, 3), low interest rates, and other accommodative weapons of the United States Federal Reserve. The economic wizards at the Fed have heralded they will not change to a tightening course anytime soon. Don’t forget the European Central Bank’s gradual even if roundabout surrender to easy money principles (especially over the last year). Recall the generous central bankers of China, the United Kingdom, and Switzerland. In the interconnected global economy, the more widespread and sustained the money printing and related policies, the more likely that there eventually will be upward price moves in consumer prices (and similar measures) as well as interest rate increases.

A more specific focus on the Japanese situation reveals the three other considerations. For starters, the Japanese business community (exporters especially) has become extremely upset (not merely worried) by the Yen’s sustained strength. This dismay increased due to a recent noteworthy GDP slump. Business interests (Japan, Inc.) significantly influence Japanese political policies. Second, Japan likely will enshrine a new governing political party after its December 2012 elections. These incoming political leaders apparently seek an even easier monetary policy than presently exists.

The third relates to the towering Japanese government debt and ongoing substantial budget deficits. Most political pundits and marketplace mavens bemoan the looming United States fiscal cliff. Japan, unlike America, wins praise as being a nation of savers (creditors) rather than debtors (borrowers). However, the Japanese government, unlike its citizens, does not incarnate thriftiness.

The current and medium term Japanese fiscal outlook, even without a change in government policies, is no cause for complacency. The Japanese political (economic) establishment, regardless of party, engages in brinkmanship, for it has shown little inclination to subdue that substantial deficit spending and massive and growing government debt. Compare the United States awesome near term and long run federal debt vista. Thus Japan probably already is fairly close to the border of a fiscal crisis. Read the rest of this entry »

The bloody retreat in the Euro currency that began in spring 2011 signaled a slowdown in the worldwide economic recovery that commenced around early 2009. The Euro FX’s mournful slump does not merely reflect Europe’s sovereign debt and banking crisis. In an interconnected international economy, Europe does not fight alone. Thus Euro FX weakness underscores the ongoing global economic disaster that emerged in 2007. The Euro currency’s further breakdown since late winter 2012 warns audiences of growing worldwide economic feebleness. The Euro FX will continue to depreciate.

European policy makers and some other viewers likewise pay attention to measures of the real European effective exchange rate (CPI deflated; first quarter 1999 equals 100; “EER”). This effective exchange rate probably is superior to cross rates (such as the one against the US dollar) as an indicator of Eurozone currency strength/weakness (and the Eurozone crisis). The European Central Bank provides data for the 17 Euro area countries against a group of 20 trading partners.

The EER established its major high in April 2008 at 111.8 (monthly average). The low during the October 2008 to April 2009 period, during which the Euro FX cross against the US dollar touched lows, was November 2008’s 102.8. However, after marching up to 111.2 in October 2009 (thus bordering on the April 2008 pinnacle), the EER started traveling downhill. On an effective exchange rate basis, it made an important bottom in June 2010 at 98.1. Although it retrenched and climbed to an April 2011 height at 103.4, this April elevation only slightly exceeded the November 2008 depth.

Under almost relentless assault, the Euro EER measure has crumbled since April 2011. This sustained bear move thus emphasizes the weakness of the global economic recovery. For June 2012, this real effective exchange rate is about 94.8. This decisively breaks beneath the key floor of June 2010 at 98.1 (the December 2011 level also was 98.1; a 10pc fall form April 2008 is 100.6). The Euro effective exchange rate erosion in very recent months, and particularly the shattering of June 2010 support, reflect both the fearsome Eurozone crisis (and recession in many European nations) and confirm the deteriorating prospects on the international front.

Further significant depreciation of the Euro FX may well turn out to be part of the solution for the Eurozone’s ongoing sovereign debt (banking; economic; debt, leverage; political) crisis.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Eurozone- Its Currency Under Assault (7-9-12)