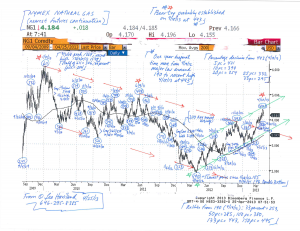

US NATURAL GAS TRENDS: BOTTLED UP (c) Leo Haviland September 30, 2013

What is the outlook for United States natural gas prices (NYMEX nearest futures continuation)? Assume normal weather. From now through winter 2013-14, and probably for at least several months thereafter, the marketplace will be trapped in a sideways pattern.

From now through winter 2013-14, near term (on balance) bearish considerations and longer term (net) bullish ones intertwine to bottle up US natural gas prices. The American natural gas supply/demand situation from the production and consumption sides for the remainder of 2013 and calendar 2014 on balance is slightly bearish. Inventory days coverage becomes somewhat more bearish at end March 2014 relative to end October 2013. Natural gas demand from the key electric power sector arguably will not ascend much in the near term unless prices sustain dips under 350. Electricity demand for calendar 2014 grows very little year-on-year. To what extent will increasing supplies of energy from renewable sources put a lid on gas demand?

However, substantial US LNG exports represent a key bullish prospect for the relatively distant future. Coal plant retirements should underpin natural gas prices over the long run. The nation does not appear to be rushing to construct new nuclear power facilities. Although Mexico is currently a modest outlet for American gas exports, it is a growing one. Over the long run, what about demand for natural gas powered vehicles?

Recall spring 2013’s important highs just under 445 (4/18/13 at 443; 5/1/13 at 444) as well as the significant lows around 305 to 313 (305 on 1/2/13; 313 on 2/15/13 and 8/8/13). Between now and the close of winter 2013-14, the broad price range probably extends from roughly 280/310 to 440/460. Around 350 is a so-called equilibrium point within this price tunnel. It will take abnormal weather to provoke breaks of the extremes of this range during winter 2013-14, especially the high end (or beneath 280). Assuming this upcoming winter is neither unusually warm nor surprisingly cold, in general this price band probably will persist for at least a few months after winter departs. However, within the next several months, a test of the NYMEX nearest futures calendar 2013 lows around 305/313 is probable.

In any event, the long term price pattern for natural gas is sideways as well, though the top of the range probably extends to around 500/530 (or higher), with the amount of LNG exports, the extent of natural gas production increases at higher price levels (particularly at 400 and up), and the extent of US economic growth being crucial considerations.

Read the rest of this entry »