PLAYING IN THE BAND: OPEC AND OIL PRICES © Leo Haviland October 25, 2016

Not long after July 2008’s major peak in crude oil prices, the European Central Bank President, Jean-Claude Trichet, declared that “predictions of the future prices of commodities are probably the most difficult exercise you can imagine.” (“Introductory Remarks with Q&A”, 8/7/08)

****

CONCLUSION

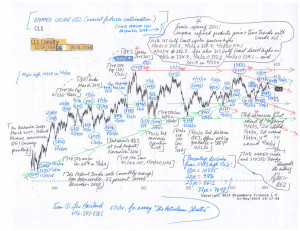

OPEC, finally fearful of sustained low petroleum prices and renewed price slumps, troubled by elevated oil production and lofty inventories, formally met 9/28/16 in Algiers. The ministers established a crude oil production target range of 32.5 to 33.0 million barrels per day, beneath estimated September 2016 production of around 33.5mmbd. This agreement reflects a Saudi Arabian policy shift. That nation and its allies apparently will no longer countenance (risk) benchmark Brent/North Sea crude oil prices under around $35 to $40 per barrel for an extended period. OPEC ministers have engaged in dialogue with non-OPEC oil producers regarding output schemes. OPEC gathers 11/30/16 in Vienna. Output apparently will not be cut prior to the November meeting (Financial Times, 9/30/16, p20).

OPEC’s rhetoric and general policy approach likely will help support Brent/North Sea at prices around a $35-$40 range. However, for the near term, OPEC’s actions thus far in the context of the global supply/demand picture probably make it challenging for petroleum prices to sustain elevations more than a few dollars above their mid-October 2016 levels (on a nearest futures continuation basis, Brent/North Sea crude oil around $54, NYMEX around $52). Why? First, OPEC has not adopted specific country-based output reductions. Moreover, given ongoing quarrels within the organization, whether it will do so in November 2016 or even implement them in practice is uncertain.

In addition, actual OPEC crude production of 32.5/33.0mmbd probably will begin cutting oil stockpiles only by sometime around mid-2017.

Ongoing serious dialogue with crucial non-OPEC producers such as Russia represents a victory for OPEC. Suppose production cuts by notable non-OPEC nations combined with genuine OPEC discipline; that probably would help to rally prices above recent highs. The Saudi Arabian oil minister claimed that many nations will join OPEC in cutting production (Bloomberg, 10/19/16). However, he did not name names. If non-OPEC countries support OPEC measures, it is not nearly as clear as the Saudi minister claims that non-OPEC lands will slash output. A production freeze by Russia (and perhaps Mexico and other emerging marketplaces) is more likely, but even that is not certain. Russia’s President suggests his country is “ready to join the joint measures [freeze or production cut] to cap production” (Financial Times, 10/11/16, p20). Recall the 2/16/16 output freeze conversation between Saudi Arabia, Qatar, Venezuela, and Russia did not result in a production cut.

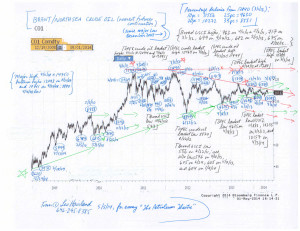

THE PETROLEUM RALLY: IS AN INTERMISSION APPROACHING?

Key resistance for NYMEX crude oil (nearest futures continuation) is the $51 to $52 band. The recent high was 10/19/16’s $51.93. This inched over 6/9/16’s $51.67 and represents nearly a 100 percent rally from February 2016’s $26.05 bottom. Brent/North Sea’s (nearest futures) high was 10/10/16 at $53.73 (6/9/16 top $52.86). Although petroleum and American natural gas do not always travel in similar fashion (“move together”), this crude oil timing parallels 10/13/16’s NYMEX natural gas top around 3.37. Although NYMEX crude oil prices have not fallen far from 10/19/16’s elevation, a five percent drop gives about $49.35, a ten pc one around $6.75.

Remember that OPEC, despite its enthusiastic September 2016 wordplay, and despite its making progress in dialogue with some non-OPEC members, does not have a well-defined (specific) production agreement (with specific quotas) yet. Its current crude oil output remains high.

A weaker US dollar arguably assists petroleum price rallies. But although the broad real US TWD (monthly average, Federal Reserve, H.10) is moderately weaker than its January 2016 pinnacle, the TWD remains strong. At 97.9 in September 2016, it stands above March 2009’s 96.8 major top (S+P 500 major low in March 2009).

The new record high in the S+P 500, 8/15/16’s 2194, surpasses 5/20/15’s noteworthy pinnacle at 2135, but not decisively (only by 2.8pc). The MXEF (emerging stock marketplaces) remains beneath its 4/27/15 top at 1069 (as well as previous highs in its downtrend: 1212 on 4/27/11 and 1104 on 9/4/14).

There are some signs of rising government interest rates, at least in the United States. The UST 10 year note is around 1.75 percent, up from 7/6/16’s 1.32pc. See “Running for Cover: Foreign Official Holdings of US Treasury Securities” (10/13/16). Although the Fed probably will not raise the Federal Funds rate in its 11/1-2/16 meeting (prior to the 11/8/16 US election), it may elect to do so in its 12/13-14/16 gathering.

Global economic growth remains relatively sluggish. Significant sovereign or corporate debt problems exist in many important countries.

****

Sometimes significant patterns and heights in net noncommercial petroleum positions can be in rhythm with important oil price trends. The current net noncommercial long position in petroleum is extremely substantial and probably is vulnerable to liquidation. A widespread run for the exits by such noncommercial longs likely would undermine petroleum prices.

FOLLOW THE LINK BELOW to download this article as a PDF file.

Playing in the Band- OPEC and Oil Prices (10-25-16)