DÉJÀ VU (ENCORE): US MARKETPLACE HISTORY © Leo Haviland October 4, 2015

CONCLUSION

Via its rhetoric and September 2015 managerial decision to delay a Fed Funds rate increase, the Federal Reserve has battled to halt the S+P 500’s decline relative to its May 2015 peak at around ten percent. Hints by the European Central Bank and Japanese policymakers regarding their potential willingness to embark on additional quantitative easing interrelate with this Fed quest. However, the International Monetary Fund head warns: “global growth will likely be weaker this year than last, with only a modest acceleration expected in 2016”; “we see global growth that is disappointing and uneven” (“Managing the Transition to a Healthier Global Economy”; 9/30/15). The World Trade Organization cut its 2015 forecast of global trade expansion from 3.3 percent to 2.8pc, lowering that for 2016 to 3.9pc from 4.0pc (9/30/15). The WTO says risks to this prediction are on the downside.

Worldwide economic growth probably will be feebler than the IMF expects. In today’s intertwined international economy, this overall economic weakness, which is not confined to emerging/developing nations, will help to undermine American GDP growth. The S+P 500 will remain volatile, but it probably will continue to decline, eventually breaking beneath its August 2015 low. The broad real trade-weighted United States dollar will stay relatively strong.

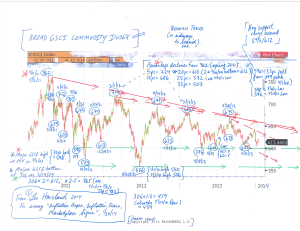

Marketplace history for US stocks and other financial domains obviously need not repeat itself, either in whole or in part. A slump in the S+P 500 of roughly twenty percent or more from its spring 2015 pinnacle nevertheless probably would inspire memories of 2007-09. After all, not only is the dollar strong, but also emerging marketplace stocks and commodities “in general” have collapsed over the past few years, and notably since second half 2014.

The strong US dollar, the substantial tumble in emerging stock marketplaces, and the crash in commodities in general reflect (confirm; encourage) global economic weakness (slowing growth). Overall debt levels as a percentage of nominal GDP in America (and many other places) remain elevated despite the economic recovery since 2009. The United States has made no progress in reducing its long run federal fiscal deficit problem. These trends are ominous bearish indicators for the S+P 500. What other variables currently or potentially confirm the probability of economic weakness in the US (and elsewhere)? Let’s focus on the US economic and political scene.

****

The broad real trade-weighted US dollar (“TWD”) established a major bottom at 80.5 in July 2011 (Federal Reserve, H.10; monthly average). By September 2015, it had run up to 97.9. Not only does September 2015 exceed March 2009’s 96.9 high, attained at the depths of the worldwide economic disaster (and alongside the S+P 500’s March 2009 major low at 667). The TWD’s 21.6 percent appreciation in its current bull move exceeds the 15.1pc TWD advance during from April 2008 to March 2009. Keep in mind that although the S+P 500’s major high in October 2007 at 1576 preceded April 2008’s TWD trough, its 5/19/08 final top at 1440 roughly coincided with that April 2008 TWD low.

****

Review Moody’s Baa index of corporate bonds (this signpost includes all industries, not just the industrial sector; average maturity 30 years, minimum maturity 20 years; Federal Reserve, H.15). Despite the Fed’s continued unwillingness to raise the Federal Funds rate, such yield repression in recent months has not prevented the modest yet rather steady rise in medium-grade US corporate debt yields. In addition, the yield spread between that corporate debt index and the 30 year US Treasury bond has widened. Although these rate moves have not shifted as dramatically as they did during the worldwide financial crisis, they likewise warn of (confirm) US (and global) economic weakness.

****

FOLLOW THE LINK BELOW to download this article as a PDF file.

Deja Vu (Encore)- US Marketplace History (10-4-15)