US DOLLAR TRAVELS: CROSSTOWN TRAFFIC © Leo Haviland July 2, 2019

“But, darlin’ can’t you see my signals turn from green to red

And with you I can see a traffic jam straight up ahead”. Jimi Hendrix, “Crosstown Traffic”

****

CONCLUSION

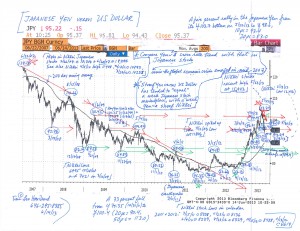

The broad real trade-weighted United States dollar’s December 2016 (at 103.3)/January 2017 (103.1) peak likely will remain intact (“TWD”; based on goods only; Federal Reserve Board, H.10; monthly average, March 1973=100). The high since then, December 2018’s crest at 102.0, stands slightly beneath this, as does May 2019’s 101.6 (June 2019 was 101.1). December 2018/May 2019’s plateau probably forms a double top in conjunction with December 2016/January 2017’s pinnacle. If the TWD breaks through the December 2016/January 2017 roadblock, it probably will not do so by much. The majestic long-running major bull charge in the dollar which commenced in July 2011 at 80.5 has reached the finish line, or soon will do so.

Unlike the broad real trade-weighted dollar, the broad nominal trade-weighted dollar (goods only) has daily data. The broad nominal US dollar probably also formed twin peaks. It achieved an initial top on 12/28/16 (at 128.9) and 1/3/17 (128.8). The nominal TWD’s recent high, 5/31/19’s 129.6, edges only half of one percent over the 2016/17 high.

The depreciation in the broad real trade-weighted dollar from its 103.3/103.1 elevation probably will be at least five percent, and very possibly ten percent. This retreat likely will last at least for several months.

****

The broad real trade-weighted dollar’s level and patterns are relevant for and interrelate with those in key stock, interest rate, commodity, and real estate marketplaces. The extent to which and reasons why foreign exchange levels and trends (whether for the US dollar or any other currency) converge and diverge from (lead/lag) those in stock, interest rate, commodity, and other marketplaces is a matter of subjective perspective. Opinions differ.

For related marketplace analysis, see essays such as: “Petroleum: Rolling and Tumbling” (6/10/19); “Wall Street Talking, Yield Hunting, and Running for Cover” (5/14/19); “Economic Growth Fears: Stock and Interest Rate Adventures” (4/2/19); “American Economic Growth: Cycles, Yield Spreads, and Stocks” (3/4/19); “Facing a Wall: Emerging US Dollar Weakness” (1/15/19); “American Housing: a Marketplace Weathervane” (12/4/18); “Twists, Turns, and Turmoil: US and Other Government Note Trends” (11/12/18); “Japan: Financial Archery, Shooting Arrows” (10/5/18); “Stock Marketplace Maneuvers: Convergence and Divergence” (9/4/18); “China at a Crossroads: Economic and Political Danger Signs” (8/5/18); “Shakin’ All Over: Marketplace Convergence and Divergence” (6/18/18); “History on Stage: Marketplace Scenes” (8/9/17).

ON THE ROAD AGAIN

“We’ll be watching out for trouble, yeah (All down the line)

And we keep the motor running, yeah (All down the line)”, The Rolling Stones, “All Down the Line”

****

What interrelated phenomena currently are sparking, or will tend to encourage, near term and long run US dollar weakness?

Growing faith that America’s Federal Reserve Board not only will refrain from raising the Federal Funds rate anytime soon, but even may reduce it over the next several months, is a critical factor in the construction of the latest segment (December 2018 to the present) of the TWD’s resistance barrier. The Fed Chairman and other US central bank policemen speak of the need for “patience” on the rate increase front. The Fed eagerly promotes its “symmetric” two percent inflation objective (6/19/19 FOMC decision), which blows a horn that it may permit inflation to exceed (move symmetrically around) their revered two percent destination.

By reducing the likelihood of near term boosts in the Federal Funds rate, and particularly by increasing the odds of lowering this signpost, the Fed gatekeeper thereby cuts the probability of yield increases for US government debt securities. The Fed thus makes the US dollar less appealing (less likely to appreciate further) in the perspective of many marketplace players.

The Fed’s less aggressive rate scheme (at minimum, a pause in its “normalization” process) mitigates enthusiasm for the US dollar from those aiming to take advantage of interest rate yield differentials (as well as those hoping for appreciation in the value of other dollar-denominated assets such as American stocks or real estate relative to the foreign exchange value of the given home currency). This is despite negative yields in German, Japanese, and other government debt securities. Capital flows into the dollar may slow, or even reverse to some extent.

The yield for the US Treasury 10 year note, after topping around 3.25 percent in early October 2018, has backtracked further in recent months. The UST resumed its drop from 4/17/19’s minor top at 2.62pc, nosediving from 5/28/19’s 2.32pc elevation. Since late June 2019, its yield has bounced around 2.00pc.

****

The current United States Administration probably wants a weaker US dollar relative to its current elevation in order to stimulate the economy as the 2020 elections approach. President Trump claimed that the European Central Bank, by deliberately pushing down the Euro FX’s value against the dollar, has been unfair, making it easier for the Euro Area to compete against the US (New York Times, 6/19/19, ppA1, 9). Recall his complaints about China’s currency policies as well. The President’s repeated loud sirens that the Federal Reserve made mistakes by raising its policy rates, and instead should be lowering them also messages that the Administration wants the dollar to depreciate.

Another consideration constructing a noteworthy broad real TWD top is mild, even if nervous, optimism that tariff battles and other aspects of trade wars between America and many of its key trading partners (especially China) will become less fierce. Both the United States and China increasingly are fearful regarding the ability of their nations to maintain adequate real GDP increases.

FOLLOW THE LINK BELOW to download this article as a PDF file.

US Dollar Travels- Crosstown Traffic (7-2-19)