GLOBAL ECONOMICS AND POLITICS

Leo Haviland provides clients with original, provocative, cutting-edge fundamental supply/demand and technical research on major financial marketplaces and trends. He also offers independent consulting and risk management advice.

Haviland’s expertise is macro. He focuses on the intertwining of equity, debt, currency, and commodity arenas, including the political players, regulatory approaches, social factors, and rhetoric that affect them. In a changing and dynamic global economy, Haviland’s mission remains constant – to give timely, value-added marketplace insights and foresights.

Leo Haviland has three decades of experience in the Wall Street trading environment. He has worked for Goldman Sachs, Sempra Energy Trading, and other institutions. In his research and sales career in stock, interest rate, foreign exchange, and commodity battlefields, he has dealt with numerous and diverse financial institutions and individuals. Haviland is a graduate of the University of Chicago (Phi Beta Kappa) and the Cornell Law School.

Subscribe to Leo Haviland’s BLOG to receive updates and new marketplace essays.

The Federal Reserve Board continues to stress via its wonderful forward guidance strategy that it will keep policy rates extremely low. However, the sustained rally in United States Treasury government yields shows that marketplace confidence in the Fed’s ability to manage (repress) interest rates, especially at the long end of the yield curve, has fallen. Look at the UST 10 year note. Not only did its yield bottom around 1.38 percent on 7/25/12. Not only did yields climb further from lows near 1.55pc (11/16/12 and 12/6/12). They have spiked from 5/1/13’s 1.61pc, touching 2.75pc 7/8/13. And this spike has continued even after the Fed underlined in recent weeks that it would not “taper” its money printing (and other easy money games) too quickly.

The ability of central bank maneuvers to sustain substantial economic growth (and repress government yields and rally the S+P 500 and related equities) probably has weakened.

Rising sovereign debt yields do not always reflect or portend economic growth (recovery) or higher stock marketplace prices. In the current marketplace playing field, rising interest rates in America (and elsewhere) also seem to be “leading” equity marketplace declines. Suppose the US government 10 year rate marches higher from current levels (or even if it stays relatively high versus its summer 2012 and May 2013 bottoms). Suppose the S+P 500 is unable to exceed (or break much above) its May 2013 height and that it declines beneath its late June 2013 low around 1560. The rising yields and falling equities will underscore that the easy money game of the Fed and its central banking allies increasingly strains credibility and thus has diminished substantially in its effectiveness.

In any event, it nevertheless stretches credibility to claim that these recent ECB and BoE statements represent a change of genuine significance. They appear to be clever ploys to boost confidence in the ability of the central banks to help guide and sustain recovery. How likely was (is) it that the ECB or the BoE were (are) going to raise rates anytime soon? Not only is much of Europe in recession, but Europe’s economic crisis (including sovereign and banking debt and related bailout issues) persists. Noteworthy troubles still loom in Greece, Ireland, Portugal, Cyprus, as well as in Spain and arguably in Italy. Moreover, recall the ECB President’s inspiring “whatever it takes” talk about a year ago (7/26/12); people gave substantial credence to that open-ended proclamation.

Consequently, these recent ECB and BoE remarks, like the cheerleading comments by Federal Reserve and Chinese officials after the June 2013 stock marketplace lows, look like a sign of weakness. Are the ECB and BoE losing some of their hold on the distant section of the yield curve? Yes. Again underscore the steady creep higher in longer run government rates in the United States (and many other arenas) despite keeping Federal Funds near the ground.

Read the rest of this entry »

Petroleum is a key part of the broad GSCI and many other commodity indices. Of course not all commodities travel in the same direction, for they have diverse supply/demand situations. And marketplace timing relationships are not precise; commodities (even within a specific sector such as petroleum) do not all embark in a bull or bear trend at or around the same time. The overall petroleum complex, a key chapter in the commodities in general story, nevertheless has marched more or less alongside the S+P 500.

Each of the assorted petroleum spreads has its own supply/demand variables. Picture a front-to-back intramarket NYMEX crude oil spread or a US Gulf Coast gasoline crack (refining margin) spread. An analytical connection portraying a relationship between petroleum spreads to the S+P 500 and economic recovery (decline) and Federal Reserve policies may seem to be a fairly long stretch.

Yet the price and time movements of one or more important petroleum spreads often “confirm” or warn of changes in outright price trends in the overall petroleum price complex (and its individual marketplaces such as Brent/NSea crude oil, or US Gulf Coast gasoline). So in a web where flat price petroleum patterns generally (roughly) coincide with those of the broad GSCI, trends in oil spreads offer guidance to the broad GSCI trend. Given the rather close bull (and bear) shifts between the GSCI and the S+P 500, petroleum spreads therefore sometimes can offer insight into S+P 500 trends (and into US and international economic growth trends as well). And so Federal Reserve policies tie into some petroleum spread marketplaces. Keep in mind, however, that perceived connections between petroleum spreads and these other domains are only guidelines, and they are not unchanging. Read the rest of this entry »

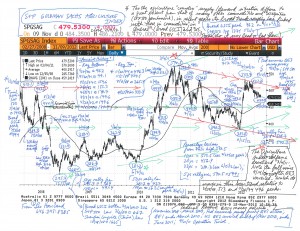

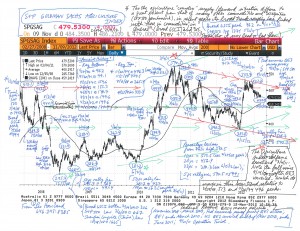

Regarding the S+P Goldman Sachs Agriculture Index (11/12/12):

Thus in recent years, some major trends in the Goldman Sachs Agriculture Index have paralleled those in the broad GSCI and US stocks (S+P 500). There of course have been leads (lags) in the timing of major price turns between the GS Ag Index and the broad GSCI and the S+P 500.

Despite a rally to the 7/20/12 plateau at 534, the recent failure of the Ag Index to sustain a move over the 2/27/08 summit around 513 and the 496 peak of almost 40 years ago (11/20/74; also see the price gap in summer 2012 around that 496 level) is a bearish sign. So is the Ag Index’s erosion since- and despite- the Federal Reserve’s announcement of QE3 money printing on 9/13/12. Since 9/14/12, note the similar slumps in the S+P 500 and the broad GSCI.

Chart Analysis- Goldman Sachs Agriculture Index (11-12-12)

Regarding metals marketplaces (“Metals, Marketplaces, and Meltdowns”, 11/8/12):

In 2011, key base and precious metals began bear trends. Take a look at the attached charts. Though different metals commenced their descents at various times, they all have fallen. Even gold has not surpassed its 9/6/11 top at 1921.

The Federal Reserve unveiled a third round of money printing 9/13/12. However, unlike what occurred after QE1 and QE2, US stocks (S+P 500 and Dow Jones Industrial Average) have not sustained an advance. Stock and commodity bulls might argue that only a few weeks have passed since mid-September. Nevertheless, the S+P 500 (9/14/12 at 1475) and Dow Jones Industrial Average (10/5/12 at 13662) made highs and then slumped. Declines in gold, silver, and the London Metal Exchange’s LMEX Index (and Brent/NSea and NYMEX crude oil) coincide with the 9/14/12 to 10/5/12 top in stocks.

In recent years, price and time trends of commodities “in general” and stocks have roughly mirrored (“confirmed”) each other. Thus the weakness in the overall metals complex is a noteworthy bearish warning sign for US (and “related”) equity marketplaces.

Read the rest of this entry »

The world’s long-running economic crisis of course has not limited itself to either one nation or one region. However, at its outset in 2007, most did not anticipate the scope or length of the disaster. Weren’t potential risks to the international economy rather modest? Weren’t issues related to the United States real estate marketplace mostly relevant only to that domain and that nation, and likely to be restricted to them? Yet substantial debt and leverage (and other intertwined issues) and their consequences were not confined either to American territory or the real estate playground.

The recent Eurozone chapters of this terrible trouble supposedly started with so-called peripheral nations such as Greece, Portugal, and Ireland. Countries such as Greece indeed first captured headlines. However, that does not demonstrate that causes of Eurozone problems necessarily started only in them. In any event, “difficulties on the periphery” engulfed the rest of Europe and traveled around the globe.

Despite broad concerns regarding worldwide economic problems and risks, despite the widespread past and current fascination with the European scene, suppose one focuses on aspects of the American stage, beginning with some highlights involving the United States alongside Canada and Mexico in the foreign exchange context. This survey of America and its geographic neighbors underlines the weakness of the United States dollar and the size of America’s fiscal troubles. This suggests the merit of inquiring into US currency, stock, interest rate, and commodity marketplace past and future relationships in the context of Federal Reserve easing policies and America’s fiscal problems.

The broad real trade-weighted dollar probably will continue to weaken. The dangerous United States fiscal situation probably will not be genuinely fixed in the next several months. A full- fledged threat of a federal fiscal catastrophe likely will be necessary for sufficient progress in that sphere to occur. Though the United States is not the center of the universe, the effects of further dollar feebleness and the worsening of the country’s fiscal crisis will radiate worldwide.

The S+P 500 has made or soon will make a significant peak.

Thus the emerging (current) story and trend appears to be: weaker dollar (TWD), weaker S+P 500, and higher government rates (UST 10 year benchmark). This vision admittedly is dramatically different from the current popular faith in these marketplace relationships.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

American Marketplaces- At the Crossroads (10-15-12)

Charts- US Dollar v Canadian Dollar, Mexican Peso (10-15-12)