GLOBAL ECONOMICS AND POLITICS

Leo Haviland provides clients with original, provocative, cutting-edge fundamental supply/demand and technical research on major financial marketplaces and trends. He also offers independent consulting and risk management advice.

Haviland’s expertise is macro. He focuses on the intertwining of equity, debt, currency, and commodity arenas, including the political players, regulatory approaches, social factors, and rhetoric that affect them. In a changing and dynamic global economy, Haviland’s mission remains constant – to give timely, value-added marketplace insights and foresights.

Leo Haviland has three decades of experience in the Wall Street trading environment. He has worked for Goldman Sachs, Sempra Energy Trading, and other institutions. In his research and sales career in stock, interest rate, foreign exchange, and commodity battlefields, he has dealt with numerous and diverse financial institutions and individuals. Haviland is a graduate of the University of Chicago (Phi Beta Kappa) and the Cornell Law School.

Subscribe to Leo Haviland’s BLOG to receive updates and new marketplace essays.

Shakespeare proclaims in “As You Like It” (Act II, Scene VII):

“All the world’s a stage,

And all the men and women merely players”.

THE 2016 WORLDWIDE ECONOMIC STAGE

As the 2016 international economic (and political) drama commences, the worldwide economy not only is sluggish, but also feebler than most forecasters assert. International real GDP, as well as that in the United States, has a notable chance of slowing down further than many expect (the International Monetary Fund predicts real global output will increase 3.6 percent in calendar 2016; “World Economic Outlook”, Chapter 1, Table 1.1).

The ability of the Federal Reserve Board, European Central Bank, Bank of England, Bank of Japan, China’s central bank, and their friends to engineer their versions of desirable outcomes via highly accommodative policies has diminished. Beloved schemes such as quantitative easing (money printing) and yield repression and related rhetoric are becoming less influential. Ongoing significant political divisions and conflicts (America’s troubling carnival represents only one example) likely will make it challenging for political leaders to significantly promote substantial (adequate) growth.

The failure of longer term US government yields such as the UST 10 year note to rise substantially despite the Fed’s recent modest boost in the Federal Funds rate represents a noteworthy warning sign regarding American and global financial prospects. Note also very low sovereign yields in much of the Eurozone (picture Germany); Japanese government rates remain near the ground floor. However, yields of less creditworthy debt instruments, whether sovereign or corporate, probably will continue to climb in 2016, another ominous indication.

For the near term at least, the broad real trade-weighted US dollar probably will remain strong. Emerging marketplace equities and commodities “in general” likely will persist in bear trends. What does the rally of the dollar above its late August/September 2015 heights signal? What does the collapse of benchmark commodity indices such as the broad GSCI beneath their late August 2015 lows portend? These warn not only of worldwide economic weakness, but also of further declines in the S+P 500. Note that emerging marketplace stocks hover fairly closely to their 2015 depths. The S+P 500 probably will remain in a sideways to bearish trend.

FOLLOW THE LINK BELOW to download this article as a PDF file.

The Curtain Rises- 2016 Marketplace Theaters (1-4-16)

In recent months, economic and political excitement within assorted emerging, developing, and frontier nations have entranced most marketplace observers and captured the attention of numerous politicians in the United States and other so-called advanced nations. In contrast, Japan, having once been in the limelight, nowadays stands in the background of the international financial theater. However, Japan currently deserves more of a starring role.

Japan’s changing political leadership in late 2012 and the subsequent major new round of substantial monetary laxness encouraged major- and intertwined- Japanese Yen weakness and Japanese equity (Nikkei) strength. The new Japanese policies, the Nikkei’s stratospheric rally, and the Yen’s rapid bear tumble probably helped to encourage global economic optimism in general as well as rallies in the S+P 500 and many other key world stock marketplaces in particular.

Yet at present, many players nevertheless increasingly take for granted Japan’s extraordinary monetary easing actions of early 2013 (and related other parts of “Abenomics”) and their marketplace consequences. Clairvoyants likewise currently place comparatively little emphasis on Japan’s current sluggish GDP prospects. They also do not underline that both the Japanese Yen and Nikkei apparently entered into a sideways trend beginning around late May 2013.

Of course diverse and entangled variables influence economic levels and trends (and storytelling about them), whether in Japan or elsewhere. But because Japan rather recently ventured on such extraordinary monetary easing, signs of mediocre Japanese economic performance warn that other very lax central bank policies increasingly will have diminished growth benefits as time passes. For example, the International Monetary Fund predicts Japan’s calendar 2015 real GDP will increase merely one percent. Japan also has not escaped its gloomy government spending and debt situation. The sideways trends in the Nikkei and Yen arguably reflect such current (potential) Japanese performance.

The recent high in Japanese stocks and bottom in the Yen probably will not be broken by much if at all any time soon. Also, a notable (even if not major) decline in the Nikkei from its recent peak alongside a rally in the Yen relative to its recent low will be a bearish sign for the world economy as well as for the S+P 500 and many other stock marketplaces.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Japan- the Land of the Setting Sun (3-7-14)

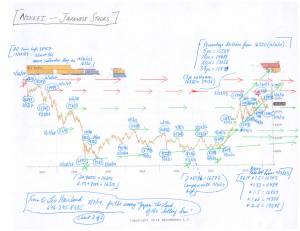

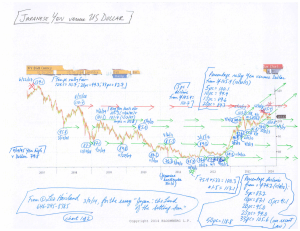

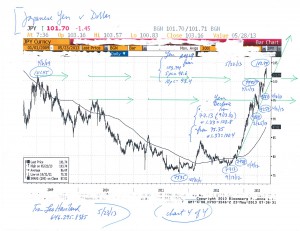

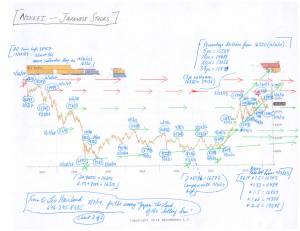

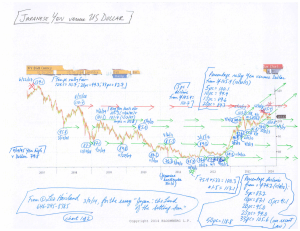

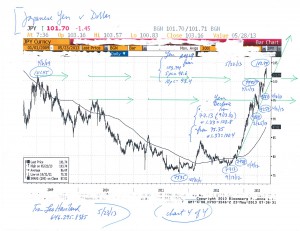

Charts- Japanese Yen and Nikkei (3-7-14)

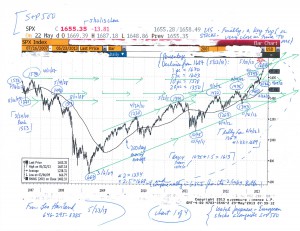

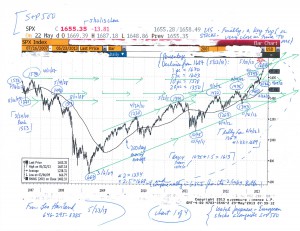

See the following four charts of US stocks (S+P 500), broad Goldman Sachs Commodity Index, Japanese stocks (Nikkei), and the Japanese Yen versus the US dollar.

The S+P 500 chart states: “US Stocks: Finally, a key top (or very close in time to one)” and gives “percentage declines from 1687 (5/22/13)”. It adds: “watch Japanese + European stocks alongside S+P 500”. Note the comments on the other charts.

Charts- S+P 500, Broad GSCI, Nikkei, Yen (5-23-13, for US Stocks- Finally, a Key Top essay)

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

US Stocks- Finally, a Key Top (Or Very Close in Time to One) (5-23-13)

Note the nearness in time of noteworthy marketplace turns in Japanese and American government notes and bonds in recent years. See those in equities as well.

In fragile, deteriorating, or desperate economic times, who do businesses and individuals call for support or salvation? Central bank firefighters and agile politicians head rescue lists of many firms and consumers.

What if Japanese owners decide to liquidate, or be smaller net buyers, of US Treasury securities? All else equal, this will make it harder for the US to finance its gaping fiscal deficit. What happens to United States interest rates and the dollar if other asset holders, not just Japanese ones, buy US Treasuries with less enthusiasm, or become net sellers? If this scenario emerges, the friendly Federal Reserve (a buyer of last resort) could elect to embark on yet another round of quantitative easing (money printing) sometime after the current round ends in June 2011.

As the broad real trade-weighted dollar (“TWD”) in recent months has attained historic lows (1973-present), further TWD feebleness (which probably would involve a resumed Yen rally versus the dollar) helps to make US asset holders in general (not just Japanese players) rather uneasy. How tolerant will foreigners remain of US dollar weakness, the American fiscal circus, and inflationary risks from extravagant Fed money printing? What if foreign buying of US assets in general, not just US Treasuries, dwindles or becomes net selling? In this script, the slumping dollar and increasing US interest rates help to undermine US stock prices.

US equities probably will keep edging up for while longer, breaking the 2/18/11 S+P 500 level of 1344. However, they probably will not ascend much above this. A five percent rally above 1344 carries to about 1410. Recall the final high in the last bull move at 1440 (5/19/08) and the initial high just over 1460 (2/22/07). Twice the March 2009 low of 667 is 1334. Stock bull moves can last a long time, but a two year rally (especially with a doubling of the index) is substantial in time terms. Though the adage that “timing is everything” is inescapable, a noteworthy high in the next few months looks likely.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Agricultural Prices and Inflation (Desperate Housewives, Episode 9 )