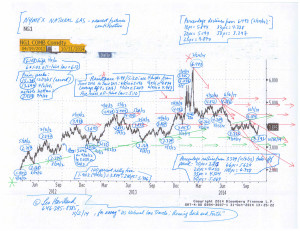

US NATURAL GAS: ON THE ROAD © Leo Haviland August 2, 2015

The probable avenue for the United States natural gas marketplace (NYMEX nearest futures continuation basis) for the next several months is a range between 2.15 and 3.40. The major bear trend that followed 2/24/14’s major peak at 6.493 attained a key bottom with 4/27/15’s 2.443 low. Was this a major low? Perhaps, but prices probably will challenge that level again and perhaps modestly break it over the next several months.

But why? After all, assuming normal weather, current and anticipated upcoming natural gas days coverage through winter 2015-16 tend to support prices, particularly in the context of NYMEX natural gas prices well under 4.00. Historical analysis indicates the bear trend from February 2014 to April 2015 travelled sufficiently far in price and duration terms to justify a shift to a neutral to bullish outlook. Also, the last prior major low, 1.902 on 4/19/12, likewise occurred in calendar April. Many key bottoms have occurred around contract expiration. In addition, many significant marketplace trend changes in natural gas (and petroleum) roughly coincide with very elevated net long or short noncommercial positions. From the historical perspective, the net noncommercial short position was very large around the time of April 2015’s low; the net noncommercial length likewise was substantial around the time of the February 2014 peak.

Natural gas prices often travel substantially independently of both petroleum (and commodities “in general”) and so-called “international” or “financial” factors. However, especially since mid-to-late June 2014 and into calendar 2015, bearish natural gas price movements have intertwined with those in the petroleum complex and the bull move in the broad real trade-weighted US dollar. The retreats since their spring 2015 highs in the commodities complex in general and petroleum in particular fit with similar slumps in natural gas. Petroleum likely will remain weak and the US dollar will remain strong for the near term, which will be bearish factors for American natural gas prices.

Quite a few marketplace observers believe the US natural gas marketplace will have massive inventories at the end of calendar 2016 build season (end October). This bearish perspective also weighs on prices. Although such oversupply probably will not occur (assume normal weather), such views are not unreasonable.

FOLLOW THE LINK BELOW to download this article as a PDF file.

US Natural Gas- On the Road (8-2-15)