ECONOMIC AND POLITICAL LINES (c) Leo Haviland October 22, 2012

Highlight two International Monetary Fund comments in its recently unveiled “Fiscal Monitor” (October 2012). “With downside risks in the global economy mounting, policymakers must once again tread the narrow path that will permit them to continue strengthening the public finances while avoiding an excessive withdrawal of fiscal support for a still-fragile economic recovery.” (page ix). And: “In most advanced economies, the near-term fiscal stance has to walk the fine line between continued adjustment and supporting the economy.” (p6).

This IMF rhetoric, which many other luminaries embrace, of “tread the narrow path” and “walk the fine line” offers hope for the global economy and for the United States in particular. Maybe subtle financial and political sorcerers somehow can escape the dilemma of an economic downturn (too slow growth or recession) and the consequences of additional (irresponsible) substantial deficit spending! Have faith that wise guardians can discover a middle way to evade further suffering!

In the amazing Goldilocks Era, didn’t substantial and growing worldwide debt and leverage joyously promise and provide nearly limitless opportunity for almost everyone (“us”) to prosper with very little (or at least manageable) risk? In the aftermath of the wonderful Goldilocks epoch, should we believe that the implications of significant leverage and mountainous debt accumulation can be magically pain-free, at least over some misty medium term or long run vista?

Despite such entrancing sermons of narrow paths and fine lines from many respected central banking and political guides, economic and political pilgrims should ask if such a path or line exists in practice. It probably doesn’t. Is there really a way for the United States to avoid the looming fiscal cliff and other long run deficit challenges without significant hardship? Probably not.

Most observers are not focusing closely on the potential composition of the Senate. They should. The Senate election result probably will have notable consequences for legislative action (or inaction) in many domains. For example, think of the troubling fiscal cliff and the terrifying long run deficit problems.

Clairvoyants on balance believe the Democrats probably will maintain control of the Senate. Even if the Republicans gain an edge in the Senate, it would be very surprising for them to capture anything close to 60 seats. According to Senate rules, to end debate (halt filibusters) on a legislative proposal (bill), 60 of the 100 Senators must agree to do so (invoke cloture). The sixty votes do not have to all be from the same party. Nevertheless, the failure of a Senate majority party to control 60 or more Senate seats means that its opponents generally can block the majority party’s legislative efforts.

So suppose the House is Republican, and the Senate is Democratic (or even imagine a modest Republican majority). Given such Congressional division, it will be a major challenge for the parties to readily resolve issues over which they disagree dramatically, such as on how to repair the federal deficit disaster. In that situation, the party membership of the winner of the duel for the Presidency matters much less. After all, for the past several years, the Republican House and the Democratic Senate stubbornly have faced each other. With these battle lines, there has been at best little progress on reducing the deficit. Why should having a Republican President instead of a Democratic one change this partisan deadlock in any notable fashion?

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Economic and Political Lines (10-22-12)

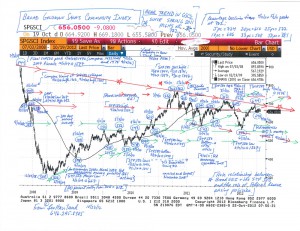

Chart- Commodities- Broad GSCI (10-22-12)