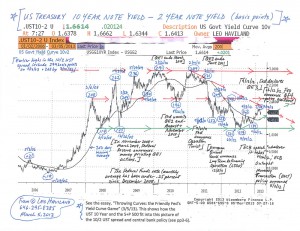

TWO-STEPPING: US GOVERNMENT SECURITIES © Leo Haviland December 1, 2015

In the film noir “Double Indemnity” (Billy Wilder, director), Walter Neff describes the murder tale as “Kind of a crazy story with a crazy twist to it.”

****

OVERVIEW AND CONCLUSION

Over the last seven years, through the last stage of the bloody worldwide economic crisis and the ensuing often fitful recovery, through dramatic and sometimes violent swings in assorted financial playgrounds, America’s heroic Federal Reserve ferociously has pinned the Federal Funds rate to the ground.

Many marketplace clairvoyants believe this widely-beloved guardian relatively soon will cautiously begin prodding the Funds rate higher. The next Fed gatherings are 12/15-16/15, 1/26-27/16, and 3/15-16/16. Maybe the courageous Fed will lift the rate up 25 basis points in its December 2015 meeting! In any case, as the widely-watched United States government two year note resides near the Fed Funds rate from the yield curve perspective, the two year US Treasury level and trend in part reflect marketplace opinions regarding Fed policy shifts and inflation.

In any case, the recent elevations in the two year US Treasury note a few basis points over .90 percent probably will not be broken by much in the near future. There indeed are some signs that United States inflation has edged toward the Fed’s two percent target. The Fed also proclaims its desire to normalize its highly accommodative policy. Yet the Fed embraces a gradual approach and does not want to make any missteps. Also, the international economy (look at the Eurozone and China) has slowed. So the Fed probably will patiently assess the consequences of its rate move for the United States (and global) economy and marketplaces (such as the S+P 500 and the US dollar).

****

Yield levels and relationships obviously can fluctuate for all sorts of reasons. However, the falling rate trend for the US 10 year government note since early 2014 contrasts with the rising one for the UST two year note. The drop in 10 year UST yields, as it is occurring in the face of some US inflation and rising two year rates and artful Fed pillow talk about normalizing policy, arguably reflects economic weakness (mediocre GDP growth) in the US or elsewhere. In today’s interconnected world, feebleness elsewhere influences the American scene.

Note a related warning signal of actual or impending US economic weakness consistent with the fall in 10 year UST yields. Since the advent of money printing in the US in late 2008/early 2009, narrowing of the 10 year less two year spread roughly has coincided with the ending of that quantitative easing. This spread tightening (becoming less positive) in turn has reflected slower economic growth (or worries regarding potential weakness or recession). The agile Fed announced the actual first round of “tapering” (gradual ending of its latest QE venture) on 12/13/13, after several reductions in the QE program, tapering finished at end October 2014. The Treasury spread currently is close to its July 2012 depth.

Is a hunt for yield, fearful flight to quality, or need to own high-grade collateral more focused on the long end of the US government yield curve than the short end? Perhaps, but not necessarily. As the ECB extends its money printing program, is a shortage of long dated Eurozone government debt not only pushing yields there lower, but also thereby reducing yields for the UST long term instruments such as the 10 year? Perhaps. But economic weakness remains the most convincing reason for the sustained decline in UST 10 year yields since early 2014.

Consistent with the fall in the US 10 year yield and the narrowing of the 10 year versus two year yield spread, additional flags indicating weakness for the worldwide economy beckon. Although the S+P 500 remains high, emerging marketplace stocks in general and commodities continue to join hands in long-running substantial bear trends. The durable bull trend in the broad real trade-weighted dollar generally has danced in tune with the bear ones in emerging marketplace stocks and commodities.

FOLLOW THE LINK BELOW to download this article as a PDF file.

Two-Stepping- US Government Securities (12-1-15)