GLOBAL ECONOMICS AND POLITICS

Leo Haviland provides clients with original, provocative, cutting-edge fundamental supply/demand and technical research on major financial marketplaces and trends. He also offers independent consulting and risk management advice.

Haviland’s expertise is macro. He focuses on the intertwining of equity, debt, currency, and commodity arenas, including the political players, regulatory approaches, social factors, and rhetoric that affect them. In a changing and dynamic global economy, Haviland’s mission remains constant – to give timely, value-added marketplace insights and foresights.

Leo Haviland has three decades of experience in the Wall Street trading environment. He has worked for Goldman Sachs, Sempra Energy Trading, and other institutions. In his research and sales career in stock, interest rate, foreign exchange, and commodity battlefields, he has dealt with numerous and diverse financial institutions and individuals. Haviland is a graduate of the University of Chicago (Phi Beta Kappa) and the Cornell Law School.

Subscribe to Leo Haviland’s BLOG to receive updates and new marketplace essays.

The Federal Reserve Board proclaimed in June 2011 a framework of principles for an exit strategy from its extraordinary and highly accommodative monetary policy. Are their exit principles in the process of changing a little bit, and might they do so relatively soon? It seems so.

The Fed is not the only financial visionary with an exit strategy. Participants in debt, stock, currency, commodity, real estate, and other marketplaces also possess exit (and entrance) schemes and tactics.

What signs probably warn that (for whatever reason, including a potential change in Fed policy) there is a noteworthy (substantial) exit underway from long positions in the UST?

Those on the alert for bulls to exit (bears to enter) the UST corral should monitor German and Japanese sovereign debt marketplace yields. Also remember debt yields and trends for European “periphery” and emerging marketplace nations.

Of course US dollar, S+P 500, and commodity trends entangle with and help to explain exits from (and entrances into) UST (and other interest rate) playgrounds. How much convergence and divergence has there been and will there be between falling (and rising) UST yields and past and future S+P 500 patterns? If UST rates keep rising higher and higher (suppose they exceed the high achieved in the past few weeks), will the S+P 500 inevitably continue to move up and up? Other questions loom. If the Fed keeps repressing UST yields, what will the jury decide for the US dollar (either on a broad, real trade-weighted basis, or in individual crosses against the Euro FX, Japanese Yen, Chinese renminbi, and so forth).

Thus it apparently has become increasingly difficult (at least at low nominal yield levels) to captivate foreigners into buying UST notes and bonds (and T-bills too). The slowdown in overseas net buying of UST probably occurred after March 2013 as well. In this context, note the steady rise in rates since July 2012’s bottom (and the 1.55pc low on 11/16/12 and 1.56pc on 12/6/12). And after all, the US does have some inflation (now around 1.5 percent) and the first several years of the UST yield curve offers no (or very little) real return to foreigners or anyone else. The seven year note now yields around 1.60pc. Even the 10 year’s return is mediocre.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Fed Up- Other Exit Strategies (6-10-13)

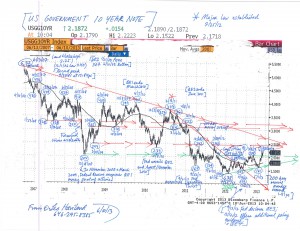

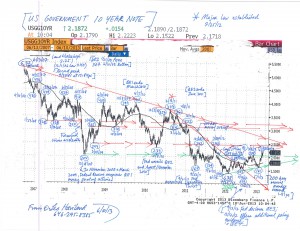

US Treasury 10 Year Note Chart (6-10-13)

Federal Reserve Board generals have underlined that they indeed possess an exit strategy for their ongoing extraordinary easing program. Such confident rhetoric regarding an escape plan indeed helps to boost the morale of many economic and political observers of marketplace battlefields. Didn’t its entrance strategy work? The Fed Funds rate has stayed near the ground floor since late 2008, United States Treasury yields have collapsed relative to their 2007 heights, and US equities (use the S+P 500 as a signpost) have soared from their March 2009 abyss.

Yet marketplace combatants should be wary of the Fed’s exit strategy design as well as its tactical implementation. It is not a detailed and finished blueprint. In actual practice, the exit strategy involves significant risk, and it probably will not be put into practice nearly as timely or smoothly as propaganda from the Fed leadership hints. How rapid, coherent, and helpful were the Fed’s policy viewpoints and actions in the early stages of the worldwide economic crisis? As the Fed’s marketplace entrance strategy and maneuvers were very remarkable and evolved over time, why should its exit plan and its application be any more “orderly”?

Yet why should the Fed’s exit strategy be without some significant pain to UST and stock owners? There’s at least a significant risk of notable wounds. After all, the rally in debt and equity prices assisted by the Fed’s massive marketplace easing generally enriched and thus pleased owners of American stocks and UST (and many other debt instruments). Besides, we know the noble Fed is not the only significant policy maker and fighter on the US (and international) economic battlefield. Thus its practical control over marketplace outcomes has significant limits.

To what extent is the Fed Chairman accurate? Is the Fed Chairman trying to minimize the role of the Fed in financing (money printing for) the deficit and to understate potential overall exit strategy issues?

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Federal Reserve Exit Strategies (2-21-13)

In love and commerce, taking implies giving. On Valentine’s Day and throughout the year, undoubtedly the prudent Federal Reserve remembers the benefits of having and needs of both debtors and creditors. This regulatory chaperone surely would declare that they passionately strive to perform their very best (do what’s most reasonable according to their interpretation of their regulatory duties) for all parties concerned. Besides, they must balance competing interests. Besides again, the Fed has a long run horizon. The Fed’s recent policies nevertheless imply not only an ethics of inflation, but also manifest somewhat greater affection for debtors than creditors.

Japan’s general government gross debt as a percent of its GDP is gigantic, at 241.0 percent for 2012 (IMF, Fiscal Monitor Update, Table 1, 1/24/12). This dwarfs America’s 107.6pc and the Euro area’s 91.1pc. Japan’s general government debt has been huge for several years. How does it keep financing this massive total? And if Japan can keep doing it, doesn’t America really have a lot of room to go (and time to wait)?

Japan may have more domestic savings than America, or be more of a nation of savers from an overall cultural perspective. Japan has run a current account surplus for quite some time, in direct contrast to the bulging United States current account deficit. (See the September 2011 World Economic Outlook, Statistical Appendix, Table A10.)

However, Japan’s ability to accumulate and finance its big general government deficit also may be due to its more favorable treatment of creditors. And despite low interest rates! Creditors of the Japanese government have earned, and have earned for quite some time, a net positive return due to deflation alongside low government interest rates.

So how long will the Fed and US Treasury get away with offering negative (or very low) real returns on US government debt?

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Sweet Talking, Slick Banking- Federal Reserve Policy (2-14-12)