THE FOREIGN EXCHANGE BATTLEFIELD: ADVANCES AND RETREATS © Leo Haviland March 5, 2015

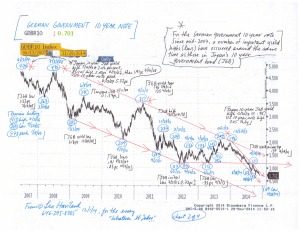

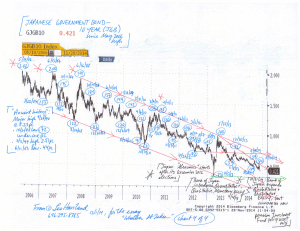

Marketplace history of course need not entirely or even substantially repeat itself. In recent years, devoted central bank generals, via diverse strategies such as sustained yield repression and massive money printing, have battled fervently to ensure sustained economic growth, manufacture sufficient inflation, and slash unemployment. Politicians have fought fiercely to ensure recovery, especially by deploying their deficit spending arsenal.

However, recall the emergence and acceleration of 2007-09”s worldwide economic crisis. And ask to what extent the serious debt and leverage problems of the Goldilocks Era genuinely have been cured.

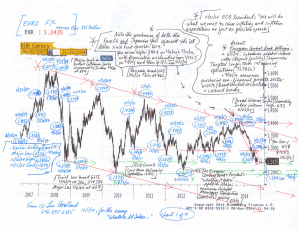

The recent sustained advance of the United States broad real trade-weighted dollar (“TWD”) warns of erosion in global economic output rates. The TWD probably will continue to appreciate.

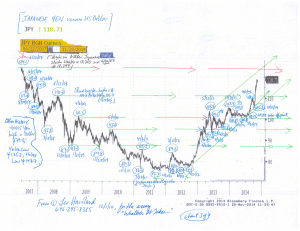

The substantial depreciation of the Euro Area and Japan real effective exchange rates (“EER”) likewise flag weakening (and oncoming reductions in) worldwide real GDP rates. So does the slump in the Canadian EER; Canada’s dive partly reflects the murderous price collapse in the commodities sector. Though Australia is not a G-7 nation, like Canada it is a developed nation and a major commodity producer. Its EER likewise has tumbled.

The United Kingdom’s EER has been fairly powerful in recent months. In part, this probably reflects the comparative economic weakness of its key trading partner, the Euro Area.

Both the US dollar and Chinese renminbi real EERs marched higher during the darker days of the fearful 2007-09 disaster. Their present-day EER patterns, though not identical, likewise have been bullish; this intertwining further indicates the likelihood that growth rates in international GDP will surrender ground. Although the Chinese EER trend has been bullish in recent months, the renminbi has retreated against the US dollar; this renminbi cross rate weakness points to a slowing Chinese economy.

****

The essay, “Crumbling BRICS: a Currency Perspective” (2-11-15), studies the effective exchange rates for Brazil, Russia, India, China, and South Africa (plus Mexico). Its analysis supports the key arguments and conclusions related to the advanced nations.

On 3/6/15, the S+P 500 celebrates the sixth anniversary of its 3/6/09 major low at 667. The stock marketplace rally since March 2009 obviously has been explosive. However, the TWD’s current trend and level, when interpreted alongside the real EERs of other G-7 advanced nations and China (and alongside other factors such as emerging stock marketplace, commodity, and interest rate trends), indicate that the S+ P 500 probably has established a notable top (2/25/15 high 2120) or will do so in the near future.

“Crumbling BRICS” states: “Recall the acceleration of the worldwide economic crisis (and decline in the S+P 500) in 2008 as the broad real TWD appreciated. The S+P 500’s major peak occurred 10/11/07 at 1576, but its final high was 5/19/08 at 1440, close in time to the April 2008 TWD bottom. The S+P 500 collapsed from around 1313 (8/18/08)/1265 (9/19/08). The S+P 500’s major bottom at 667 on 3/6/09 occurred the same month as the broad real TWD pinnacle.”

FOLLOW THE LINK BELOW to download this article as a PDF file.

The Foreign Exchange Battlefield- Advances and Retreats (3-5-15)