US INFLATION SIGNALS © Leo Haviland June 7, 2015

In their noble war to generate sufficient inflation, insure economic recovery, and slash unemployment, central bankers in America, Europe, and Japan have fought with extraordinary weapons such as monumental money printing and longstanding interest rate yield repression. On the inflation front, they battle furiously to achieve and sustain an inflation target of about two percent. This allegedly good (desirable, reasonable, prudent) goal contrasts not only with bad “excessive” inflation, but also with bad “too low” inflation and evil (or at least really bad) of deflation.

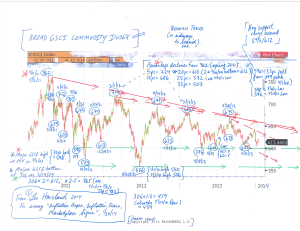

For several months, widely-watched inflationary yardsticks such as the consumer price index indicated too low inflation or inflamed worries regarding deflation. The consequences of the 2007-2009 international economic disaster probably have not disappeared, and the dramatic slump in petroleum prices after mid-2014 has troubled many inflation seekers. In any event, most economic forecasters, including central banking captains, have postponed the achievement of sufficient inflation as measured by such signposts rather far out into the future. Consequently, marketplace warriors, political leaders, and the financial media have focused relatively little on other gauges warning of notable potential for increased inflation in benchmarks such as the consumer price index.

****

The worldwide global economy of course is interconnected and complex. Numerous variables intertwine to produce any given inflation level and trend. Inflation acceleration need not appear first or strongest in beloved indicators such as consumer prices or personal consumption expenditures. Although the United States is not a financial island, focus on the American landscape.

“Inflation” is not confined to measures such as the CPI or personal consumption expenditures; “the economy” includes other inflation benchmarks. Various indicators signal there is more inflation “around” in the US than most believe. Underline American wage increases. Note central bank and marketplace murmurings regarding high valuations or so-called asset bubbles; keep in mind the climbs in US equities and home prices from their financial crisis depths. Money supply growth remains robust. The steely determination of the Fed and its central banking allies to achieve their inflation objectives heralds that monetary policy probably will remain quite lax for some time even if the US eventually raises rates. These factors collectively warn that at least in America, deflationary forces “in general” have found strong adversaries. The recent spike in key interest rates such as the 10 year US government note (and the German Bund) in part reflects this inflation.

Despite the recent rate of change in US consumer prices and personal consumption expenditures, probably neither deflation nor dangerously low inflation are on the American horizon. In addition, sustained “too low” inflation in America probably should not be a worry for the near term. Nevertheless, although a sustained jump in PCE and CPI inflation rates much beyond the Fed’s desired two percent target currently appears unlikely, “sufficient” inflation in America may be achieved faster than many predict.

****

“Flights to quality”, hunts for suitable yield (return), and other supply/demand considerations, not just low inflation statistics, can rally prices of debt securities. Yet did sustained central bank yield repression create or at least encourage “too low” yields for (a price “bubble” in) key government debt securities such as those of the United States and Germany? In the Eurozone, the terrifying enemy called deflation neared. The European Central Bank fired back with a huge quantitative easing (money printing) plan involving government debt securities. Some European government security interest rate yields went negative.

However, was a US (and German) debt security price bubble recently popped?

The 10 year US government note established an important yield low at 1.64 percent on 1/30/15, above 7/25/12’s major bottom at 1.38pc. Since January 2015’s valley, the US 10 year rate shot up about 50 percent to 6/5/15’s 2.44pc. The 1/2/14 summit at 3.05pc represents important resistance. In any case, what should the yield on US 10 year government notes be if inflation (such as in the PCE) is 1.5 percent or higher?

The 10 year German government note made a key bottom on 4/17/15 close to zero, at .05 percent (not long after the UST 10 year note made a minor low at 1.80pc on 4/3/15). Bund yields thereafter blasted higher, reaching almost one percent on 6/4/15. The Japanese 10 year JGB made a significant trough in 2015 shortly before the UST’s, on 1/20/15 at .20 percent.

US stocks advanced victoriously from their March 2009 major low for many reasons, including strong corporate earnings and share buybacks. Yet money printing and yield repression also assisted the S+P 500’s mighty ascent. So if US stocks recently reached “too high” levels, perhaps rising interest rates (or growing fears of them) will inspire those equities to retreat (burst their bubble).

Regardless of whether or not American government note yields recently were (or are still) “too low”, the recent sharp increase in UST 10 year note rates may reflect not just a “technical correction” or a growing belief that the Federal Funds rate (and thus yields in US government securities) will rise in the relatively near future. That noteworthy UST yield leap probably also warns that US inflation “in general” has grown or will do so soon.

FOLLOW THE LINK BELOW to download this article as a PDF file.

US Inflation Signals (6-7-15)