CHINESE RATES: OPENING THE GATES © Leo Haviland December 2, 2013

Although China’s economy of course differs from those of other major nations around the globe, it intertwines with them. However, China’s huge debt securities marketplace receives relatively little attention from traders, analysts, and the media in comparison to those of the United States, the Euro Area, and Japan.

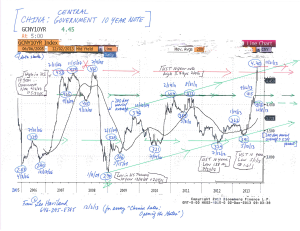

Debt, stock, currency, and commodity marketplace observers concentrating on matters such as Federal Reserve Board policy and the S+P 500’s level and trend should extend their vision to include Chinese interest rates. China’s 10 year government note, after establishing bottoms at 3.24 percent on 7/12/12 and 3.41pc on 5/10/13, has raced higher. After a brief stop at 4.02pc on 10/8/13, the note decisively crashed through 2011’s 4.10pc barrier, recently breaking through 2007-08’s wall around 4.60pc to reach its recent high of 4.70pc on 11/21/13. The one year government note yield likewise has ascended significantly. Chinese government interest rates probably will continue to climb higher.

Near-universal optimism reigns regarding China’s economic situation and prospects. Even if the national economy is relatively robust, it may be less so than many believe.

Given China’s obvious importance to the world economy, a greater than expected slowdown in the marvelous Chinese growth rate, in part due to sustained higher yields, probably would entangle with and undermine recovery prospects in other territories. Moreover, since the end of the joyous Goldilocks Era and during the dreadful international economic crisis and the subsequent recovery, many turning points in the 10 year Chinese government note have occurred around the same time as those in benchmark 10 year US Treasury and German government notes. Thus despite the yield repression policy tightly embraced by the Federal Reserve and its central banking allies, the notable ascent in Chinese government interest rate yields underlines that the overall long run trend for yields in most key nations is probably higher.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Chinese Rates- Opening the Gates (12-2-13)

Chart- Chinese Government 10 Year Note (for essay, Chinese Rates- Opening the Gates) (12-2-13)