FED FIXATIONS: INTEREST RATES © Leo Haviland September 24, 2012

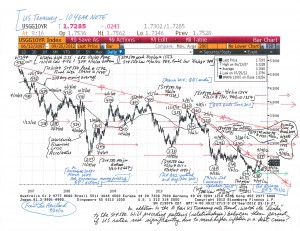

A key United States interest rate benchmark, the 10 year Treasury note, probably established a major bottom around 1.40 percent in late July 2012.

The Federal Reserve Board’s fixing of the Federal Funds rate at exceptionally low levels admittedly restrains ascents in US government yields. Its benevolent promise and determination to maintain the Funds rate almost flat on the ground until at least mid-2015 encourages faith that government yields generally will remain depressed. Also, heightened flight to quality fears and nervous leaps in recessionary worries may push the 10 year UST challenge back toward or even slightly beneath its July low. The Eurozone crisis, for example, has not disappeared. America’s 2013 federal “fiscal cliff” looms large on the horizon.

However, all else equal, a flood of money printing tends to increase inflation and thus interest rates. And all else equal, cracking or crumbling creditworthiness for a borrower- whether an individual, corporation, or government- tends to boost the interest rate charged that borrower. America nowadays confronts another round of Federal Reserve money printing and has made little headway in resolving its awesome fiscal problems.

The Federal Reserve’s long rumored (fervently hoped for) and recently decreed (9/13/12) third cascade of money printing, QE3, probably will be massive, perhaps over one trillion dollars. Over time, this deluge will help to boost US government (and other) interest rates.

Moreover, given a generous desire to avoid the fiscal cliff and a downturn, Congress probably will continue its huge deficit spending spree. Not only has America become habituated to deficit spending, debt (including personal debt), and assorted forms of entitlement. How many people volunteer nowadays to pay sufficiently more taxes to solve- or at least significantly reduce- near term (as well as long run) national fiscal troubles? For a debtor nation such as America, running substantial budget deficits alongside elevated (and thus expanding) government debt as a percentage of nominal GDP raises the risk of a severe fiscal trial. The arrival of this crisis probably will occur relatively soon rather than at some vague date many years down the road. In any event, this visit will tend to raise US government rates. The US may be an economic fortress, but that does not guarantee that its creditworthiness will be unquestioned or unchallenged. Witness Europe in recent years; also recollect the debt sagas of many emerging marketplaces.

What are key levels for the US Treasury 10 year note? Start at the low end and walk higher.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Fed Fixations- Interest Rates (9-24-12)

US Treasury 10 Year Note Chart (9-24-12)