INFLATION HOPES, DEFLATION FEARS, MARKETPLACE SIGNS © Leo Haviland January 20, 2014

In the current environment, many central bankers in so-called advanced nations such as the US, Europe, Japan, and the United Kingdom (and in many other places around the globe) have adopted an inflation ideology. The IMF’s leading light heralds in her speech: “With inflation running below many central banks’ targets, we see rising risks of deflation, which could prove disastrous for the recovery. If inflation is the genie, then deflation is the ogre that must be fought decisively.” For OECD-type (advanced) countries, one can summarize the current version of that beloved doctrine: “moderate inflation of around two percent is good, lower than that is not very good (or maybe even a little bit bad), and deflation is definitely bad.” It is unclear how much inflation (in the opinion of marketplace generals these days) would be inappropriate (bad), but arguably over five percent on a sustained basis definitely would be bad (evil; monstrous).

Suppose worldwide deflationary forces remain very significant. Perhaps credit (and debt) and leverage problems developed during the Goldilocks Era (and probably during quite a few years before then) have not been solved. Suppose the worldwide economic crisis that emerged in 2007 and accelerated in 2008 did not create sufficient deflation to remedy the inflationary issues previously built up. Then lax monetary policy at best (even if accompanied by substantial deficit spending) may create mediocre real economic growth, generate less than desired (sufficient) inflation, and only modestly improve the dismal unemployment picture.

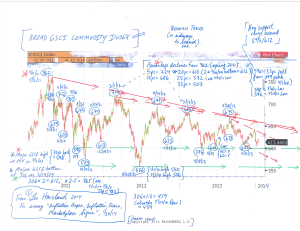

The trends of recent years show declines in real US median (and mean) income. Commodities have been in a downtrend since their peaks in spring 2011. Of course commodities are only one part of consumer price indices. And wages and incomes are not the same as consumer prices. Yet these trends in US income and the broad GSCI indicate that “inflation in general” (including such measures as the consumer price index, PCE, and GDP deflator) is strongly entrenched at low levels. In addition, unless the Fed and other central banks embark on even more massive easing than they have done thus far, this income and commodity evidence (especially when interpreted alongside the low rates of CPI-type inflation) suggests that it probably will be very difficult for “inflation in general” to rise much if at all from current low levels. And “very low” inflation (or even deflation) eventually may appear outside of the real income and commodity territories (especially if US and related interest rates leap higher).

In any event, the US income statistics and broad GSCI bear trend indicate that despite all the Fed (and other central bank) easing, the creation of sustained “sufficient” consumer price (or PCE) inflation remains a huge challenge. Given the intertwining of inflation policies and phenomena (and forecasts) with those of real GDP and unemployment, these notable wage and commodity trends hint that real GDP increases probably will be less than regulators and politicians (not just in the US) aim for, and that unemployment probably will not fall as much as desired.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Inflation Hopes, Deflation Fears, Marketplace Signs (1-20-14)

Chart- Broad GSCI (for essay, Inflation Hopes, Deflation Fears…) (1-20-14)