GLOBAL ECONOMICS AND POLITICS

Leo Haviland provides clients with original, provocative, cutting-edge fundamental supply/demand and technical research on major financial marketplaces and trends. He also offers independent consulting and risk management advice.

Haviland’s expertise is macro. He focuses on the intertwining of equity, debt, currency, and commodity arenas, including the political players, regulatory approaches, social factors, and rhetoric that affect them. In a changing and dynamic global economy, Haviland’s mission remains constant – to give timely, value-added marketplace insights and foresights.

Leo Haviland has three decades of experience in the Wall Street trading environment. He has worked for Goldman Sachs, Sempra Energy Trading, and other institutions. In his research and sales career in stock, interest rate, foreign exchange, and commodity battlefields, he has dealt with numerous and diverse financial institutions and individuals. Haviland is a graduate of the University of Chicago (Phi Beta Kappa) and the Cornell Law School.

Subscribe to Leo Haviland’s BLOG to receive updates and new marketplace essays.

Industrial metals such as copper and aluminum of course have different supply/demand fundamentals. They intertwine in diverse ways with significant movements in interest rate and currencies, especially the United States dollar. The overall base metals complex often travels in the same fashion (direction) as precious metals. Yet focus on global stock marketplaces in relation to base metals “in general”. Significantly, from the later stages of the glorious Goldilocks Era to its dreadful decline, from the ensuing worldwide recovery up to the present, trends in base metals “in general” very often show the way or confirm trends in key global stock marketplaces.

Price trends in base metals indeed have been closely tied to the China growth story. Yet significant marketplace trend changes in base metals also fit those in emerging stock marketplaces as a whole. The voyage of the base metals complex since roughly mid to late 2007 closely resembles that of emerging marketplaces “in general”. What about in relation to America’s S+P 500? Since its high on 2/14/11 at 4478, the London Metal Exchange base metal index (“LMEX”) has been in a massive bear trend, falling about 35.0 percent to its 6./24/13 low. In contrast, the S+P 500’s glittering advance has continued up to a 1730 high on 9/19/13. But as before 2011, the timing of the S+P 500’s turning points from 2011 to the present in its overall upward climb generally fit rather closely to those in the LMEX index.

The sustained decline in the base metals battleground “in general” since first quarter 2011 continues to signal slower growth in emerging marketplaces in general and in China in particular. Note the continued lowering of growth estimates for China in recent months. In addition, despite the overall directional price trend divergence between the LMEX and the S+P 500, the sustained base metal weakness warns that growth probably will be weak in advanced nations, and that the glowing strength in the S+P 500 will not be eternal.

Read the rest of this entry »

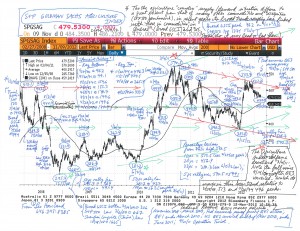

Regarding the S+P Goldman Sachs Agriculture Index (11/12/12):

Thus in recent years, some major trends in the Goldman Sachs Agriculture Index have paralleled those in the broad GSCI and US stocks (S+P 500). There of course have been leads (lags) in the timing of major price turns between the GS Ag Index and the broad GSCI and the S+P 500.

Despite a rally to the 7/20/12 plateau at 534, the recent failure of the Ag Index to sustain a move over the 2/27/08 summit around 513 and the 496 peak of almost 40 years ago (11/20/74; also see the price gap in summer 2012 around that 496 level) is a bearish sign. So is the Ag Index’s erosion since- and despite- the Federal Reserve’s announcement of QE3 money printing on 9/13/12. Since 9/14/12, note the similar slumps in the S+P 500 and the broad GSCI.

Chart Analysis- Goldman Sachs Agriculture Index (11-12-12)

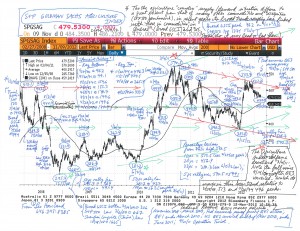

Regarding metals marketplaces (“Metals, Marketplaces, and Meltdowns”, 11/8/12):

In 2011, key base and precious metals began bear trends. Take a look at the attached charts. Though different metals commenced their descents at various times, they all have fallen. Even gold has not surpassed its 9/6/11 top at 1921.

The Federal Reserve unveiled a third round of money printing 9/13/12. However, unlike what occurred after QE1 and QE2, US stocks (S+P 500 and Dow Jones Industrial Average) have not sustained an advance. Stock and commodity bulls might argue that only a few weeks have passed since mid-September. Nevertheless, the S+P 500 (9/14/12 at 1475) and Dow Jones Industrial Average (10/5/12 at 13662) made highs and then slumped. Declines in gold, silver, and the London Metal Exchange’s LMEX Index (and Brent/NSea and NYMEX crude oil) coincide with the 9/14/12 to 10/5/12 top in stocks.

In recent years, price and time trends of commodities “in general” and stocks have roughly mirrored (“confirmed”) each other. Thus the weakness in the overall metals complex is a noteworthy bearish warning sign for US (and “related”) equity marketplaces.

Read the rest of this entry »

The onset and acceleration of vicious bear trends in base metals “in general” such as copper in 2007 and 2008 preceded or coincided with meltdowns in other stock and many other commodity marketplaces. In late 2008, the London Metal Exchange’s base metal index’s bottom dawned only about three months before the major low in the S+P 500. What about 2011? Base metals reached their 2011 summits, as during the early stage of the global economic disaster, around the time of those in the S+P 500.

Erosion in base metal prices, especially as it now coincides with tumbles in stock arenas and in many other commodity playgrounds and some strength in the battered US dollar, confirms and points to further worldwide economic weakness. These intertwined marketplace trends underline that America’s policy actions (and related ones by many other nations) such as gigantic deficit spending, massive money printing, and sustained rock-bottom government interest rates have not sufficiently solved the severe debt and leverage problems that emerged into view in 2007 and 2008.

Although a repeat of the massive price declines of 2008 are unlikely, the current bear trends of 2011 in base metals probably will continue, as will those in equities and many other commodities.

The linkage of the base metal complex to stock marketplace and US dollar moves and interest rate policies and trends underscores the benefits of paying close attention to base metals. There has been a close bond in recent years between trends in the S+P 500, commodities “in general”, and the United States dollar. For example, in 2007, the LMEX major high on 5/4/07 at 4557 preceded the S+P 500 plateau on 10/11/07 at 1576. Eventually the crucial 2008 final tops in various marketplaces arrived. Note the timing coincidence in the final highs in the LMEX (3/5 and 7/2/08), the low in the broad real trade-weighted dollar (April 2008), the final top in the S+P 500 (5/19/08, midway between the LMEX 2008 tops), and the broad Goldman Sachs Commodity Index (7/3/08). Compare the 2011 timing coincidence in tops in these various marketplace domains. For example, the LMEX high on 2/14/11 at 4478 is very close in time to the initial S+P 500 top on 2/18/11 at 1344; compare 4/18/11’s 4469 LMEX high with the S+P 500 peak on 5/2/11 at 1371.

FOLLOW THE LINK BELOW to download this market essay as a PDF file.

Metals and Meltdowns (9-26-11)