AS THE FINANCIAL WORLD TURNS: COMMODITY AND OTHER MARKETPLACE DOMAINS © Leo Haviland April 2, 2018

Chuck Berry sings in “’Round and ’Round”:

“Well, the joint started rockin’

Goin’ round and round,

Yeah, reelin’ and a rockin’,

What a crazy sound,

Well, they never stopped rockin’,

’Till the moon went down”.

****

OVERVIEW AND CONCLUSION

Many marketplace high priests enthusiastically proclaim proverbs on price relationships. For some heralds, these adages are only guidelines; however, for others, they represent high (or very high) probabilities. Such aphorisms include the links between the United States dollar and commodities “in general”, or between the US dollar and the S+P 500 or other stock indices. For example, one widely popular chant: “weak dollar equals strong commodities”, “strong dollar equals weak commodities”. For some, the word “equals” in this formula implies “is connected to”, or “associated with”.

Observers differ, often substantially, in their choice between as well as the assessment of the supposedly relevant variables (data, evidence) and analytical time horizons. Perspectives on past, current, and future convergence and divergence (lead/lag) relationships between financial marketplaces (and factors influencing them) likewise can vary significantly.

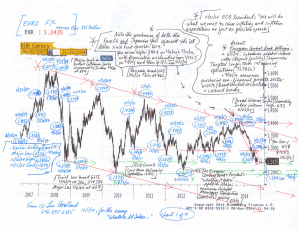

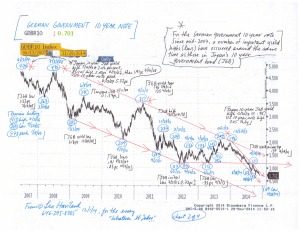

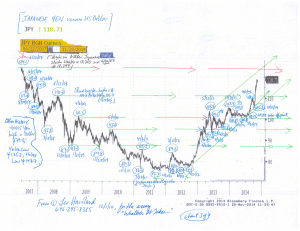

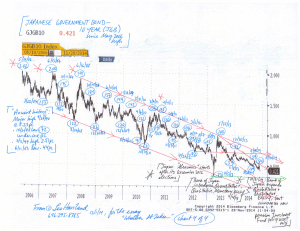

In practice, viewpoints regarding the role of the dollar in determining commodity price levels, trends, and turning points nevertheless differ, and often a great deal. After all, other financial marketplace realms (such as interest rates and stocks), diverse economic and political theaters, and a wide range of other phenomena interrelate with both the dollar (and other currencies) and assorted members of the commodities world. So a variety of competing stories and predictions about the dollar, commodities (whether in general or in regard to individual sectors such as petroleum or base metals), and other marketplaces exist and change.

Moreover, historical review indicates that trends for commodities “in general” can intertwine in various fashions with currencies (such as the United States dollar), as well as with interest rate benchmarks (picture the US 10 year government note), and stock playgrounds (the S+P 500 and related indices of advanced nations; emerging marketplace signposts). Moreover, marketplace history, whether for a given arena or the relationship between two or more fields, is not marketplace destiny.

For further related marketplace analysis of stock, interest rate, currency, and commodity fields, see other essays such as: “Global Stock Marketplaces: Winter of Discontent” (3/5/18); “There Will Be Blood: Financial Battlefields” (2/9/18); “Busload of Faith: Financial Marketplaces” (1/15/18); “Marketplace Vehicles: Going Mobile” (12/13/17); “History on Stage: Marketplace Scenes” (8/9/17).

****

In any case, let’s now focus on the historical relationship between the broad real trade-weighted US dollar (“TWD”) and commodities in general over the past several years. The table below underlines that players should be on the watch for a fairly close coincidence in timing of major or other important turning points in those two wide realms. However, in the current context, they also should monitor TWD moves in relation to the critical height around 96.0. The broad real trade-weighted US dollar (“TWD”) recently fell decisively beneath crucial support around 96.2 to 96.6. The broad real TWD high during the global financial disaster was March 2009’s 96.6.

****

What does an investigation of the petroleum, base metals, and agricultural commodity groups since their first quarter 2016 major lows unveil? Many marketplace turns have occurred around the same time. All these commodity battlefields made important highs in first quarter 2018; so did the S+P 500 and other important advanced nation and emerging marketplace stock indices.

Yet not all commodity sectors (or members within a group) necessarily dance (make turns) together. In principle and practice, potential divergence can develop and persist within the commodity universe.

However, whereas petroleum arguably very recently threatened to exceed its 1Q18 barriers, base metals and agriculture apparently did not. Determined and sustained crude oil output restraint by OPEC and its non-OPEC allies such as Russia has helped to draw down OECD petroleum industry inventories. Fears of supply interruption (Middle East tension, including the Iran nuclear issue; Libya; Nigeria; Venezuela) exist. Numerous prophets assert the world economy will remain robust. The further weakening of the dollar since around mid-year 2017 has inspired some petroleum bulls.

The net noncommercial long position of petroleum players (see the CFTC Commitments of Traders) expanded massively since mid-2017, and this net noncommercial buying probably played an important role in rallying oil prices. It remains very large and is vulnerable to liquidation.

Prices for the oil group probably will not break above their first quarter 2018 highs by much if at all. Neither will broad commodity indices such as the broad S&P Goldman Sachs Commodity Index or the Bloomberg Commodity Index. The 1Q18 peaks in the S+P 500 and MXEF stock indices are two year diagonal bull time moves from their 1Q16 major troughs. The GSCI and BCI’s first quarter 2018 highs likewise are two year diagonal ascents from their major bottoms of 1Q16.

Yet suppose the petroleum complex does attain new highs relative to those of 1Q18. As petroleum is an important part of many widely-watched commodity signposts (especially the broad S&P Goldman Sachs Commodity Index), that may boost such broad indices to levels above first quarter resistance.

It is important whether or not the base metals crew (copper, aluminum, zinc, and others) also achieves new highs, for both base metals and oil link closely to international economic growth trends (and arguably more “immediately” than agriculture does).

Many major highs (lows) for commodities “in general” have roughly coincided with major peaks (bottoms) in the S+P 500. But not all have. The 2007-2009 global economic disaster era displayed an exception. The major high in the S+P 500 (10/11/07 at 1576) preceded the GSCI’s pinnacle (7/3/08 at 894). However, the S+P 500’s final top, 5/19/08’s 1440, bordered the July 2018 commodities summit.

****

Regardless of whether or not key commodity indices achieve highs above their first quarter 2018 plateau, the first quarter 2018 resistance for the S+P 500 and other advanced and emerging marketplace equity benchmarks probably will remain in place. As “There Will Be Blood: Financial Battlefields” (2/9/18) stated: “The S+P 500’s recent high, 1/26/18’s 2873, probably was a major top.”

FOLLOW THE LINK BELOW to download this article as a PDF file.

As the Financial World Turns- Commodity and Other Marketplace Domains (4-2-18)